Investing Strategies for the Individual Investor

Copyright McAllen Investments 2007 - 2012 All Rights Reserved

Charting & Technical

Analysis

Analysis

#1

on

K

I

N

D

L

E

on

K

I

N

D

L

E

Market Trends

"Scary as Hell"

"Scary as Hell"

Trading the Trends

Stop being a 'LOSER'

Invest and Trade safely with Trading the Trends. Get out of the market at the highs - avoid the corrections - avoid bear markets - Profit on the upswings - keep your money safe when the market tanks! Buy-and-Hold is a Loser's Strategy!

*Make money in ANY market.

* 318 pages

of the very best investing and trading knowledge - ever...

Invest and Trade safely with Trading the Trends. Get out of the market at the highs - avoid the corrections - avoid bear markets - Profit on the upswings - keep your money safe when the market tanks! Buy-and-Hold is a Loser's Strategy!

*Make money in ANY market.

* 318 pages

of the very best investing and trading knowledge - ever...

Frankly, I am going to show you three charts that will be very insightful, and at the same time might scare the bejesus out of you. No, I am not 'Chicken Little', I am not predicting a market crash, or that the investment world is going to hell in a hand-basket. But this is not 'Oz' either.

With that in mind, my goal is to offer every individual investor and trader the tools to be successful in any market environment. Whether you use these tools or not, is your choice.

Let's start with recent market history:

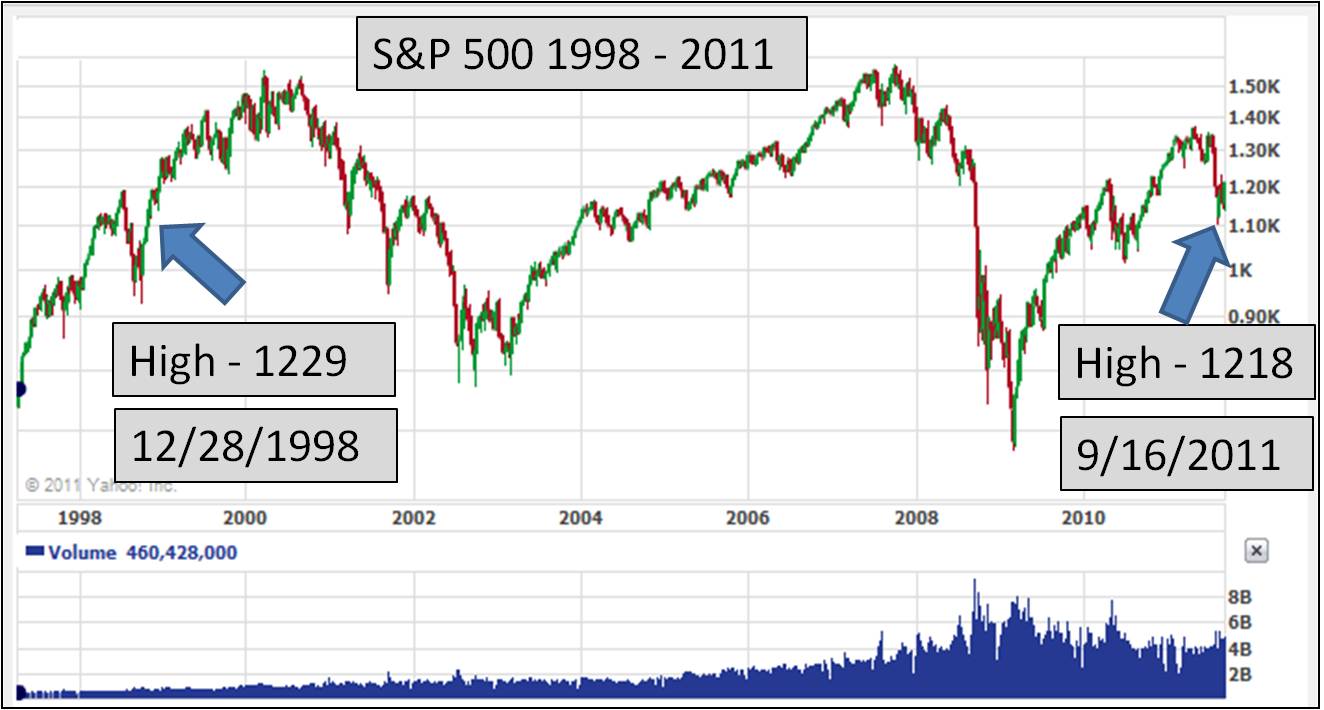

For more than a decade, investors have watched the market go up, only to go right back down and take back all the gains while giving many huge losses. Here's the real story.

Currently, the market is still below the highs of 1998. See 13-year chart below.

With that in mind, my goal is to offer every individual investor and trader the tools to be successful in any market environment. Whether you use these tools or not, is your choice.

Let's start with recent market history:

For more than a decade, investors have watched the market go up, only to go right back down and take back all the gains while giving many huge losses. Here's the real story.

Currently, the market is still below the highs of 1998. See 13-year chart below.

Admittedly, the above chart is not all that shocking. After all, most investors and traders already realize the market has gone nowhere for the past decade. The past decade has even been referred to as "The Lost Decade" when it comes to investing returns. By now, many have even realized that we are in a Secular Bear Market, which means a long-term bear market cycle that started in 2000.

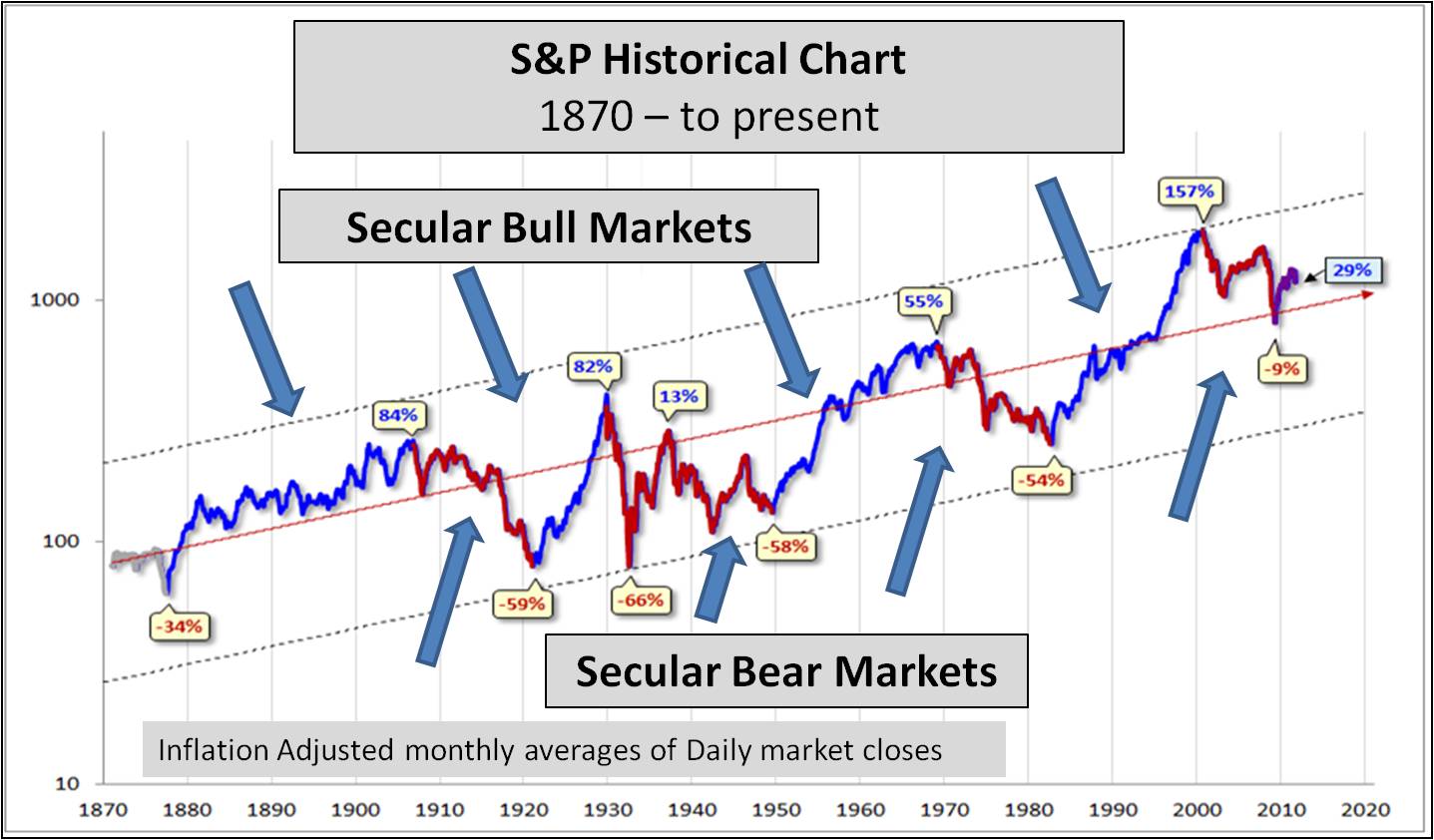

The following chart is a more historical market view. It shows all of the Secular (long-term) Bull and Bear markets for the past 140 years.

The following chart is a more historical market view. It shows all of the Secular (long-term) Bull and Bear markets for the past 140 years.

The above chart includes a regression trend line and the percentages the market has moved above and below that line. Also included are dotted trend lines based on the low in 1932 and the high in 2000. These lines form a channel. This keeps the major market moves more in perspective.

As you can see, every Secular Bear Market in the past has moved more than 50% below the regression trend line. Yet the current Secular Bear Market, as of the 2009 low, has only moved 9% below. That should get your attention!

This is where it gets more interesting.

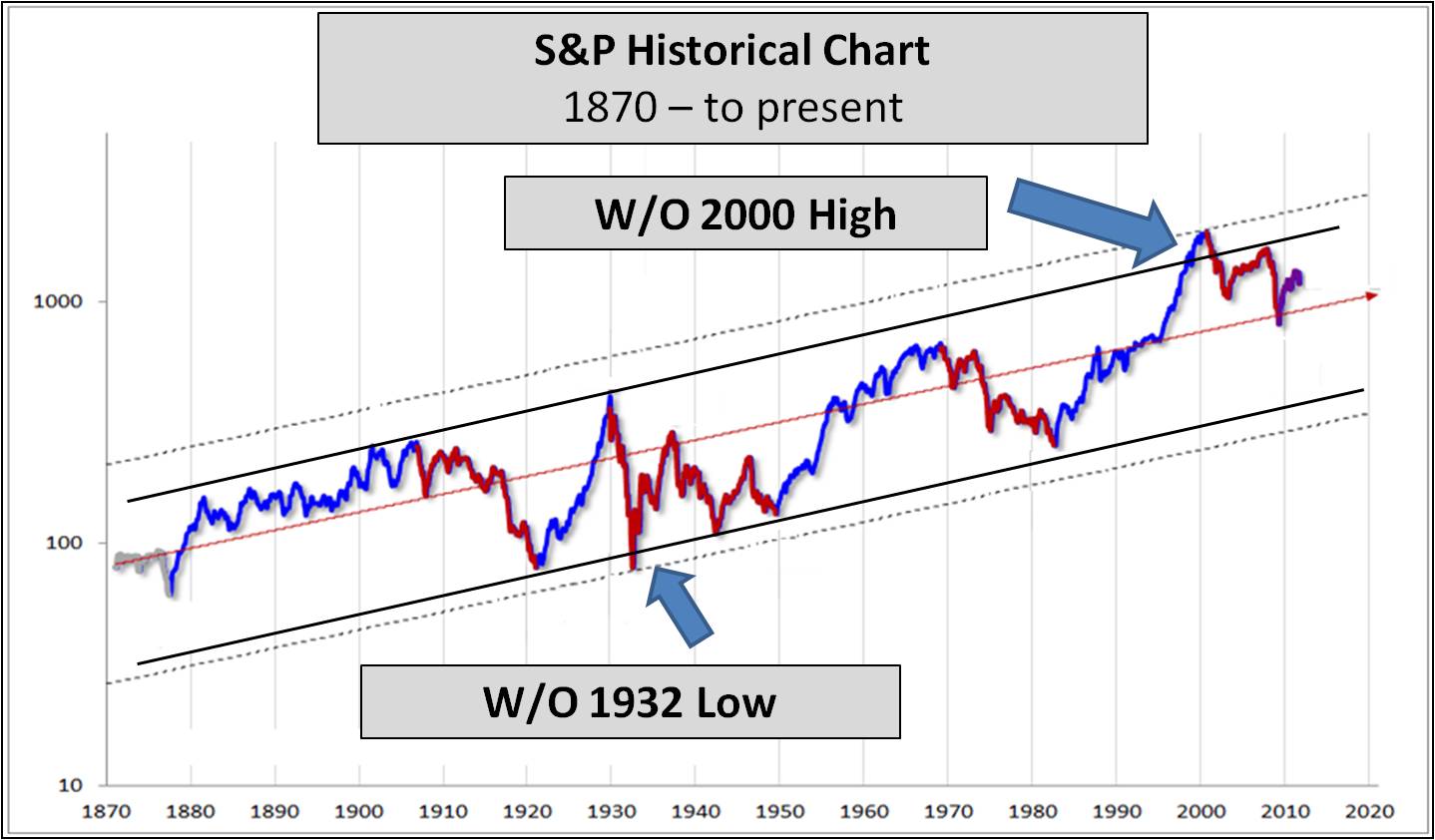

Some might think "this time it's different," or, "the low of 1932 and the high of 2000 were extremes, and as extremes should be excluded from any projections.

The following chart does just that. It eliminates the extremes by drawing a long-term trend line that does not include the extremes.

As you can see, every Secular Bear Market in the past has moved more than 50% below the regression trend line. Yet the current Secular Bear Market, as of the 2009 low, has only moved 9% below. That should get your attention!

This is where it gets more interesting.

Some might think "this time it's different," or, "the low of 1932 and the high of 2000 were extremes, and as extremes should be excluded from any projections.

The following chart does just that. It eliminates the extremes by drawing a long-term trend line that does not include the extremes.

You see, even by elliminating the extremes, the highs of 1900, 1929, and 2007 line up perfectly, and the high in the 1960s almost reached the upper channel. Also, each low after 1920 returned to the lower trend line. That is not a coincidence. That represents how incredibly accurate trends are, both long term and short term.

As the poet and philosopher George Santayana said:

"Those who cannot remember the past are condemned to repeat it."

Current Market - the scary part

The charts don't lie. Every Secular Bear Market for more than 100 years has lasted from 17 to 20 years and they have returned to the lower historical trend line. The above charts clearly show what you can reasonably expect out of the market for at least the next 5 to 10 years.

As you have probably concluded from viewing the above charts, there is a better than average chance the market may move lower from here.

To think otherwise, you must believe:

1. This Secular Bear Market will be different than any other in history.

2. The market will not return to the lower trend line as it has done 5 times in the past.

3. That even a decline of 50% will not effect your investment or trading account. (Note: it would be more than a 50% decline from current levels just to return to the trend line.)

This is why I say 'sticking your head in the sand' with a buy-and-hold strategy will get you broke!

If you are still inclined to believe buy-and-hold investing will be successful for you, then here is another bit of information you need to know.

Beginning January 1, 2011, every day for the next 19 years, ten thousand (10,000) baby boomers will reach age 65.

As you can imagine, these investors will no longer be adding to their investments like they did during their best earning years of the 1980s and 1990s. Instead, they will be taking their money out. So where will the NEW money come from to generate a sustained market advance? In other words, thinking another bull market like the one leading up to the highs in 2000 will happen any time soon is complete fallacy.

More Market information

Intermediate term Bull and Bear Markets continue to happen within the longer term Secular Bull and Bear Markets.

Stock market statistics for 110 years:

1900 - 2010

* Since 1900 there have been 29 bear markets.

* There has been a Bear Market on the average of every 3 1/2 years

* Lasting an average of 1.7 years (time in decline)

* Average decline of 29%

* Average time to return to break-even is another 1.9 years

* Bear Markets consumed 32% of the time of your investment

* Getting back to break-even took another 44% of the time

* Only 24% of the time was spent in net gain - Bull Market territory

Why is this important to you?

The last Bear Market started in 2007 and ended in 2009 after a 50% decline. They happen on average of every 3 1/2 years.

You do the Math!

Now, you know with 100% certainty that you will be hit with a 30 to 50% loss with the next Bear Market.

Are you prepared?

Do you know how to recognize a market top?

Do you know how to protect your capital?

Do you know how to make money in ANY market environment? (Even declining markets?)

OR - are you going to take the loss?

Now, the good news

First of all, know this:

A market decline of such proportions to reach the lower historical trend line is a scary thought. It would make the March 2009 market low look completely insignificant. As I said, I am not 'Chicken Little,' but this is not 'Oz' either. I am realistic. Hopefully, instead of some disasterous market crash, we will continue to gyrate up and down in a sideways/declining fashion until such time the historical trend is met once again. This scenario would certainly be preferable.

Whether that happens, or whether there's a crash landing, my point is simple.

1. The days of just buy an investment, forget about, and reap a profit someday are over. That ended in 2000.

2. This is not the same market that most investors remember. This is not the same market most Financial Advisors will lead you to believe it is.

3. To rely on the buy-and-hold strategy for success is totally unrealistic. Furthermore, it will likely get you BROKE!

You can do better. Losses of the past do not have to repeat over and over again. A successul investor does not sustain a 30 to 50% loss every few years. He does not hold through market declines, so convinced he's right that he’s willing to burn through most of his money to prove it. That's insane.

Secondly, for success:

You must know how to recognize market tops and bottoms early, as they are forming (not after the fact).

You must know how, at all times, to protect your capital from losses.

You must invest and trade with the market trends (NOT against them)

If you rely on an Advisor for your decisions and/or think diversifying will protect your money - You Will Lose.

There are two tools every investor and trader must have to be successful.

1. Knowledge of Technical Market Analysis

2. Knowledge of Market Trends and Cycles (investing and trading for either long-term or short-term)

You can be successful!

Don't wait for the market to simply beat you into submission.

Charting and Technical Analysis and Trading the Trends offers you the tools you must have for success

in ANY market environment. Learn to invest with the market trends.

You hold the key to your financial future... Whether you use it or not - is your choice.

The next step is yours...

As the poet and philosopher George Santayana said:

"Those who cannot remember the past are condemned to repeat it."

Current Market - the scary part

The charts don't lie. Every Secular Bear Market for more than 100 years has lasted from 17 to 20 years and they have returned to the lower historical trend line. The above charts clearly show what you can reasonably expect out of the market for at least the next 5 to 10 years.

As you have probably concluded from viewing the above charts, there is a better than average chance the market may move lower from here.

To think otherwise, you must believe:

1. This Secular Bear Market will be different than any other in history.

2. The market will not return to the lower trend line as it has done 5 times in the past.

3. That even a decline of 50% will not effect your investment or trading account. (Note: it would be more than a 50% decline from current levels just to return to the trend line.)

This is why I say 'sticking your head in the sand' with a buy-and-hold strategy will get you broke!

If you are still inclined to believe buy-and-hold investing will be successful for you, then here is another bit of information you need to know.

Beginning January 1, 2011, every day for the next 19 years, ten thousand (10,000) baby boomers will reach age 65.

As you can imagine, these investors will no longer be adding to their investments like they did during their best earning years of the 1980s and 1990s. Instead, they will be taking their money out. So where will the NEW money come from to generate a sustained market advance? In other words, thinking another bull market like the one leading up to the highs in 2000 will happen any time soon is complete fallacy.

More Market information

Intermediate term Bull and Bear Markets continue to happen within the longer term Secular Bull and Bear Markets.

Stock market statistics for 110 years:

1900 - 2010

* Since 1900 there have been 29 bear markets.

* There has been a Bear Market on the average of every 3 1/2 years

* Lasting an average of 1.7 years (time in decline)

* Average decline of 29%

* Average time to return to break-even is another 1.9 years

* Bear Markets consumed 32% of the time of your investment

* Getting back to break-even took another 44% of the time

* Only 24% of the time was spent in net gain - Bull Market territory

Why is this important to you?

The last Bear Market started in 2007 and ended in 2009 after a 50% decline. They happen on average of every 3 1/2 years.

You do the Math!

Now, you know with 100% certainty that you will be hit with a 30 to 50% loss with the next Bear Market.

Are you prepared?

Do you know how to recognize a market top?

Do you know how to protect your capital?

Do you know how to make money in ANY market environment? (Even declining markets?)

OR - are you going to take the loss?

Now, the good news

First of all, know this:

A market decline of such proportions to reach the lower historical trend line is a scary thought. It would make the March 2009 market low look completely insignificant. As I said, I am not 'Chicken Little,' but this is not 'Oz' either. I am realistic. Hopefully, instead of some disasterous market crash, we will continue to gyrate up and down in a sideways/declining fashion until such time the historical trend is met once again. This scenario would certainly be preferable.

Whether that happens, or whether there's a crash landing, my point is simple.

1. The days of just buy an investment, forget about, and reap a profit someday are over. That ended in 2000.

2. This is not the same market that most investors remember. This is not the same market most Financial Advisors will lead you to believe it is.

3. To rely on the buy-and-hold strategy for success is totally unrealistic. Furthermore, it will likely get you BROKE!

You can do better. Losses of the past do not have to repeat over and over again. A successul investor does not sustain a 30 to 50% loss every few years. He does not hold through market declines, so convinced he's right that he’s willing to burn through most of his money to prove it. That's insane.

Secondly, for success:

You must know how to recognize market tops and bottoms early, as they are forming (not after the fact).

You must know how, at all times, to protect your capital from losses.

You must invest and trade with the market trends (NOT against them)

If you rely on an Advisor for your decisions and/or think diversifying will protect your money - You Will Lose.

There are two tools every investor and trader must have to be successful.

1. Knowledge of Technical Market Analysis

2. Knowledge of Market Trends and Cycles (investing and trading for either long-term or short-term)

You can be successful!

Don't wait for the market to simply beat you into submission.

Charting and Technical Analysis and Trading the Trends offers you the tools you must have for success

in ANY market environment. Learn to invest with the market trends.

You hold the key to your financial future... Whether you use it or not - is your choice.

The next step is yours...

Available on Kindle

Borrow Plan

Borrow Plan

Available on Kindle

Borrow Plan

Borrow Plan

Fred McAllen

The OFFICIAL WEBSITE